does cashapp report to irs reddit

Personal Cash App accounts are exempt from the new 600 reporting rule. Airstream specifications by year Reporting Income from Cash Apps For transactions that took place in the 2022 tax year you will receive a.

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

The Internal Revenue Service IRS will be changing the way it is taxing businesses that use third-party payment services such as Zelle Venmo and Cash App to receive payments for their.

. Aug 03 2022 The American Rescue Plan however altered these rules. Mar 03 2022 The free Cash App Taxes supports most IRS forms and schedules for federal and state returns even Schedule C. Cash App is required by law to file a copy of the Form 1099-BK to the IRS for the applicable tax year.

And the IRS website says. Does cash app report personal accounts to irs. Starting January 1 2022 if your Cash App Business account has gross sales of 600 or more in a tax year Cash App must provide a Form 1099-K to the IRS.

Starting January 1 2022 if your Cash App Business account has gross sales of 600 or more in a tax year Cash. If you cant figure a precise number this year do the best you can and maybe. Cash apps must now disclose payments for goods and services that amount more than 600.

Does cashapp report to irs reddit. Its the only service weve tested that doesnt cost a dime for. Form 1099-K Payment Card and Third Party Network.

The IRS will certainly know by now that CashApp does not report customer activity in a timely accurate manner. Starting in 2022 mobile payment apps like Venmo PayPal Cash App and Zelle are required to report business transactions. Its the only service weve tested that doesnt cost a dime for.

PayPal Venmo and Cash App have made it possible for users to process transactions as friends However Zelle does not offer the option because its not subject to the. Does cash app report personal accounts to irs. Mar 03 2022 The free Cash App Taxes supports most IRS forms and schedules for federal and state returns even Schedule C.

Your Financial Goals Your SSN and your joint applicants SSN Simply fill in the form below and well send you your free guide At six stories tall Elan Financial Services is located in the large. Starting in 2022 mobile payment apps like Venmo PayPal Cash App and Zelle are required to report business transactions totaling more.

Beware Coinbase Caused Me To Be Audited By The Irs And A Lien Garnished Wages Imposed For Income I Didn T Make R Bitcoin

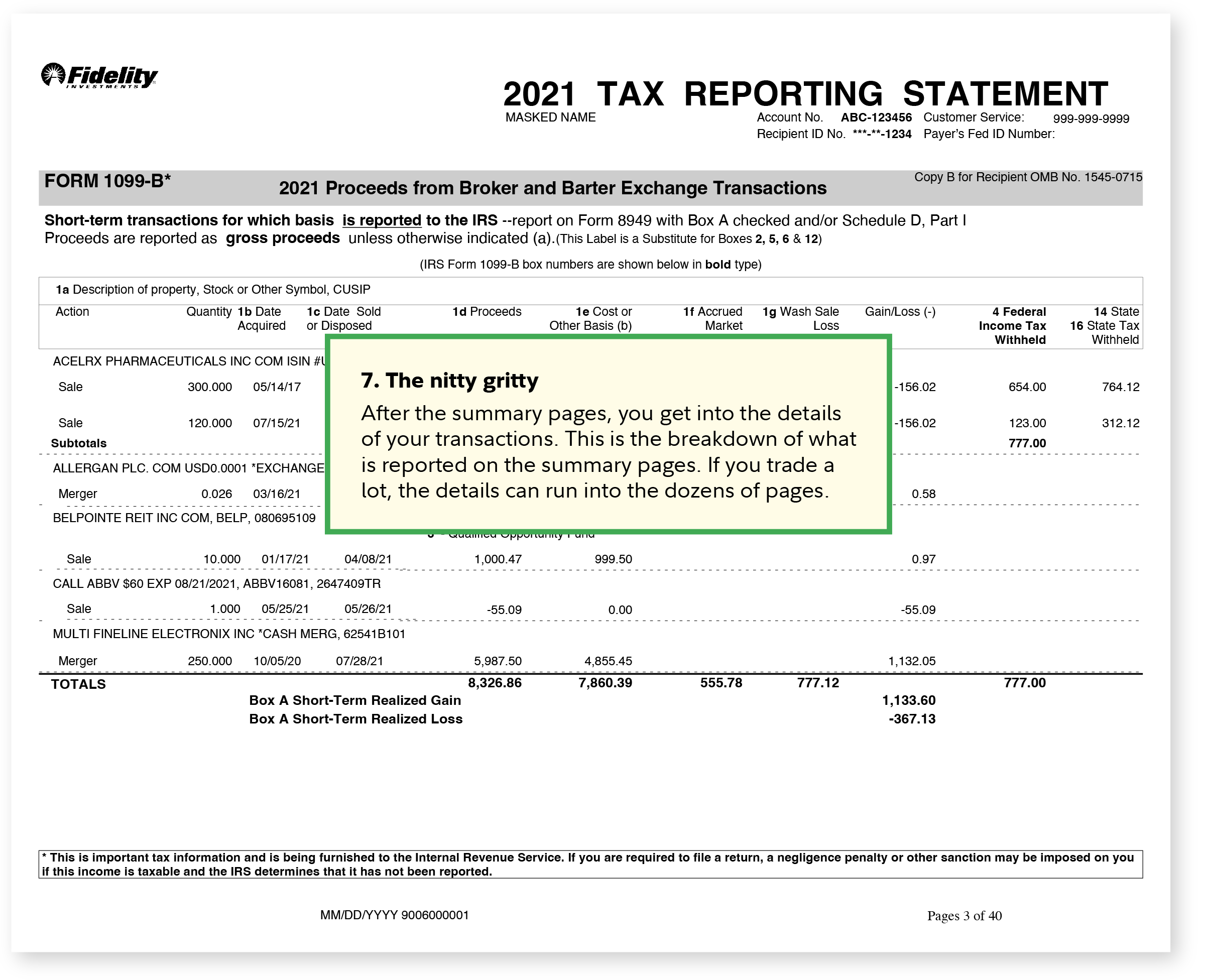

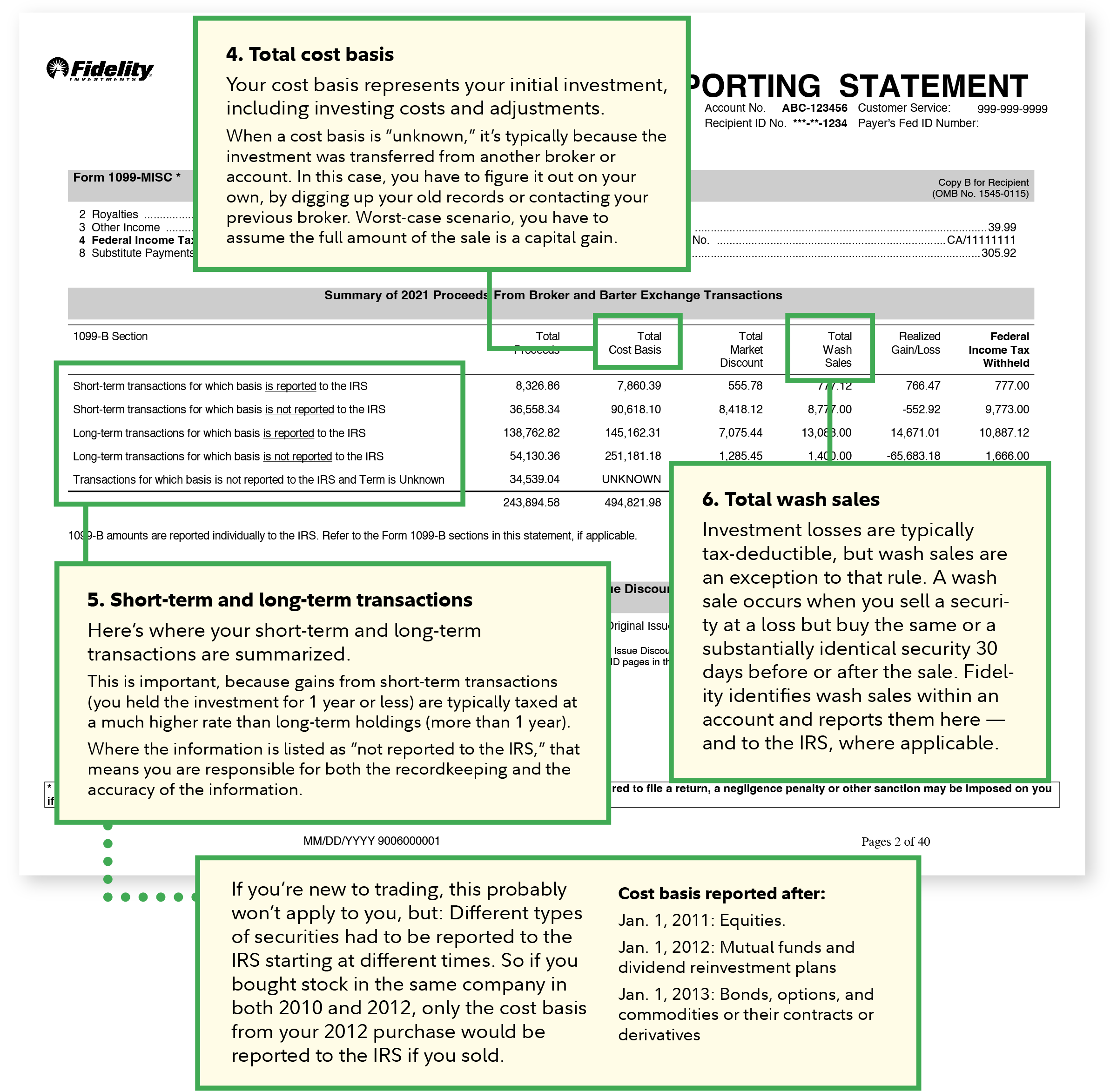

How To Read Your Brokerage 1099 Tax Form Youtube

Irs Snooping On Cash Apps It S Coming Soon Bold Tv

Reporting Income On Stolen Property Can Someone Explain This R Irs

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

Income Reporting How To Avoid Undue Taxes While Using Cash App

Irs Snooping On Cash Apps It S Coming Soon Bold Tv

Venmo Cash App Paypal To Report Transactions Of 600 Or More To Irs Marketplace

Cash App Income Is Taxable Irs Changes Rules In 2022 National Bicycle Dealers Association

Irs Notice Cp80 The Irs Hasn T Received Your Tax Return H R Block

Advice On Venmo Having To Submit Sums Over 600 To The Irs R Personalfinance

The Irs Is Clamping Down On Cash Apps Could This Affect Your Rental Business

Irs Snooping On Cash Apps It S Coming Soon Bold Tv

Does Cash App Report Personal Accounts To Irs New Rules Frugal Living Coupons And Free Stuff

Starting January 1 2022 Cash App Business Transactions Of More Than 600 Will Need To Be Reported To The Irs R Cryptocurrency